Introduction

In a world where digital transactions occur at lightning speed and personal information is often just a click away, the prevalence of scams has reached alarming levels. Understanding the fundamental elements behind these deceptive schemes is critical for prevention and awareness. "The Anatomy of a Scam: Psychological Triggers that Lure Victims" sheds light on the psychological strategies scammers employ to ensnare unsuspecting targets. With millions affected globally each year, the relevance of unpacking these psychological triggers cannot be overstated.

Why It Matters

Scams can have devastating financial consequences and emotional repercussions that last far beyond the event itself. Developing an understanding of these triggers can empower individuals to recognize warning signs and protect themselves from manipulation.

Understanding Scams: An Overview

Before delving into the psychological mechanisms at play, it’s essential to define what constitutes a scam. A scam is a deceptive scheme designed to cheat someone out of something of value, and these can take many forms – from phishing emails to Ponzi schemes.

The Framework of a Scam

To dissect a scam effectively, one must examine its framework, typically consisting of Motivation, Execution, and Outcome. Each of these pillars interacts with psychological principles to draw in victims.

The Psychological Triggers

1. Scarcity and Urgency

One of the most potent psychological triggers in scams is the manipulation of scarcity and urgency.

Case Study: The "Limited Time Offer" Scam

Overview: This scam lured victims in with ads for products available for a very short time at an extraordinary discount.

Analysis: Victims, driven by the fear of missing out (FOMO), hurriedly made purchases without conducting proper research. Scarcity creates a false sense of urgency, which blinds individuals to rational decision-making processes.

Key Insight: Understanding this trigger can empower shoppers to pause and consider the value of their decisions, rather than acting impulsively.

2. Social Proof

Humans are inherently social creatures; we look to others for cues on how to behave. This susceptibility becomes an avenue for exploitation.

Case Study: The Online Investment Scam

Overview: Scammers posted testimonials from supposed satisfied customers to entice investment in a fraudulent scheme.

Analysis: By leveraging social proof, these scammers created an illusion of legitimacy and safety, causing individuals to invest large sums, persuaded by the “success” of others.

Key Insight: Developing an understanding of social proof can aid individuals in scrutinizing testimonials critically rather than accepting them at face value.

3. Authority

The appeal to authority is another formidable psychological trigger.

Case Study: The IRS Phone Scam

Overview: Scammers impersonated IRS agents to demand immediate payment of purported tax debts.

Analysis: By presenting themselves as authoritative figures, scammers instilled fear and urgency, compelling victims to act quickly without verifying the truth.

Key Insight: Awareness of this trigger alerts individuals to verify the credentials of anyone demanding their attention, especially when personal finances are involved.

The Process of Manipulation: Building Trust

4. Too Good to Be True

Scammers often present offers that appear shockingly beneficial.

Case Study: The Lottery Scam

Overview: Victims were notified about winning a lottery that they never entered.

Analysis: Many fell for the promise of free money, disregarding the adage "if it sounds too good to be true, it probably is."

Key Insight: This serves as a reminder to critically evaluate all "too good to be true" offers, especially those requiring payment or sensitive information.

5. Emotional Appeals

Many scams prey on emotion, exploiting feelings of love, fear, or sympathy.

Case Study: Romance Scams

Overview: Scammers built online relationships and elicited money for various reasons, often pretending to be in distress.

Analysis: Emotion clouded judgment, leading victims to send money to someone they believed they cared about.

Key Insight: Recognizing emotional vulnerabilities can help individuals maintain a clear boundary between trust and gullibility in relationships formed online.

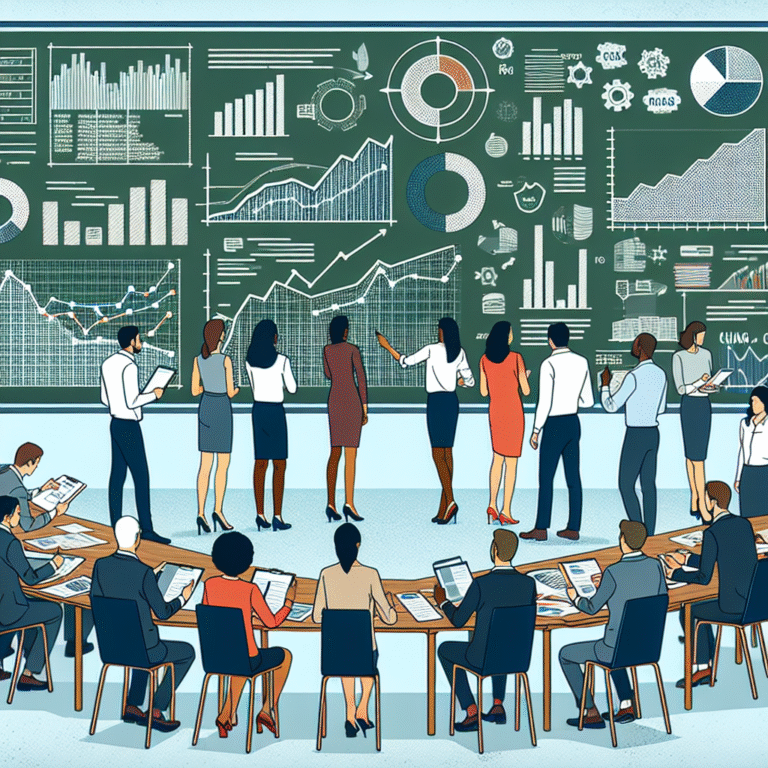

Vulnerabilities: Who Gets Targeted?

6. Demographics and Digital Behavior

Certain demographics are more vulnerable to scams.

Statistical Insights

| Demographic | Vulnerability |

|---|---|

| Seniors | Often have savings and may lack digital literacy. |

| Young Adults | Impulsive and highly engaged in online platforms. |

| New Users | Lack experience and understanding of digital transactions. |

7. Mental and Emotional State

A victim’s mental state significantly influences their susceptibility.

Case Study: Stress and Decision Making

Overview: Individuals facing stress may be more inclined to make hasty decisions, such as in financial scams.

Analysis: Stress impairs critical thinking, providing a fertile ground for scams to succeed.

Key Insight: It’s crucial to approach significant financial decisions with a grounded mindset, ensuring emotions do not dictate choices.

Conclusion

"The Anatomy of a Scam: Psychological Triggers that Lure Victims" underscores the multifaceted psychological strategies scammers utilize to exploit human nature. By understanding these triggers—scarcity, social proof, authority, emotional appeals, and individual vulnerabilities—individuals can better arm themselves against potential scams.

Through education and awareness, the public will have the tools needed to navigate a world littered with deception. Prioritize skepticism, cultivate critical thinking, and invest in knowledge to combat the threat of scams effectively.

FAQs

What are the most common types of scams?

Common scams include phishing scams, lottery scams, Ponzi schemes, romance scams, and IRS impersonation scams.

How can I protect myself from scams?

Be skeptical of offers that seem too good to be true, verify sources before acting, and avoid sharing personal information without confirmation.

Why do people fall for scams?

Victims often succumb to emotional manipulation, urgency, or a lack of understanding of the scam tactics being employed.

Are certain demographics more vulnerable to scams?

Yes, seniors, young adults, and newcomers to the digital economy often exhibit higher susceptibility.

How can I report a scam?

You can report scams to local authorities, consumer protection agencies, or online platforms that handle fraud reports.

With knowledge comes power, and understanding the psychological underpinnings of scams is a critical step toward personal and communal safety in an increasingly digital world. Share this article, empower those around you, and let’s work together to protect one another from the dark reality of scams.